子夜读书心筆

写日记的另一层妙用,就是一天辛苦下来,夜深人静,借境调心,景与心会。有了这种时时静悟的简静心态, 才有了对生活的敬重。The market, after the gut wrenching sell-off earlier, is now officially positive for the year. Things are rosy and we can embrace the new bull market, right? Not so fast.

Let's not forget we are still over 40% off from the market highs of 2008, the national deficit and debt has officially exploded past even the worst assumptions of a year ago, unemployment is racing to 10%, housing has been decimated, 2 million more homes are estimated to be foreclosed on this year, the government is the largest investor in U.S. financial institutions & has decided to arbitrarily re-write bankruptcy law and despite all this, we cannot get oil (USO) to go below $50 a barrel which means any growth or geo-political event causes a massive surge in prices (exhale).

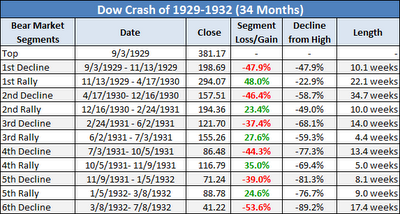

But, you say, we are positive for the year. Problem: see, we have done this before. Look at the following data from the 1929-1934 market (hat tip reader Mike for emailing it).

There were plenty of times during that market it rallied for prolonged periods but one thing remained the same, the underlying fundamentals of the economy were lousy, just like they are today. The FDR government underwent a massive spending plan designed to "boost growth", just like today (it did not work, just like today). Markets will rise on the hope "things will be better soon" as folks want to be in on the bottom. As it rises others come rushing in, not wanting to be late for the party, and the market bursts higher.

Then, things do not get better and a market that looked cheap just a few months ago based on the hope people had now looks grossly overvalued based on today's reality. Then comes the slow selloff as reality sinks in. If you look at the time frames in the above chart you see the trend. Violent rallies up followed by slow painful selloffs.

Remember, this market decline started in October 2007 after it peaked. It gained speed in September 2008 and then again in February 2009. The recent near 30% rally has taken less than a month.

We cannot sustain the rally and turn the corner until the economy does, period. "Green shoots" are meaningless....meaningless. All government officials, despite trying to talk up the economy as best they can, admit we are not even at the worst of this yet. All agree unemployment will significantly worsen and the commercial real estate issue are only now beginning to make themselves obvious.

Rumors are 10 out 19 banks failed the ill-devised "stress tests" and when results are actually released (any day?) it will only serve to diminish confidence further. The banks, who by these tests seem to be on already shaky ground, are all saying they expect consumer credit to "significantly worsen".

At the end of the day we need the economy to stabilize before we grow. We have not even begun to do that yet. If that is true, how can we take the 30% rally serious? Ought we not take it with a grain of salt? I am...